The Complete and Simple Guide to Understanding and Buying Bitcoin in 2021!

Preface:

After the holidays I had some time to reconnect with friends and family, and when the Bitcoin topic was mentioned, I’d always get asked the same three questions:

What is Bitcoin?

Is it a good investment?

How can I buy it?

So even though I always try my best to teach people about Bitcoin I might miss some details, so I wanted to make this article to make sure I provide the most complete and up to date information, and also as a guide for you to have it and come back to it if you need so.

I aim to answer those questions and more in this article, it took me a while to write it but now it’s finally ready, so please take the time to read it, share it with people, and most importantly enjoy it :)

Disclaimer: This is my own personal research, not financial advice. The companies mentioned in this article haven’t paid me in any way or form, I just happen to like them. Always do your own research as well.

With that out of the way, let’s start with some history about Bitcoin.

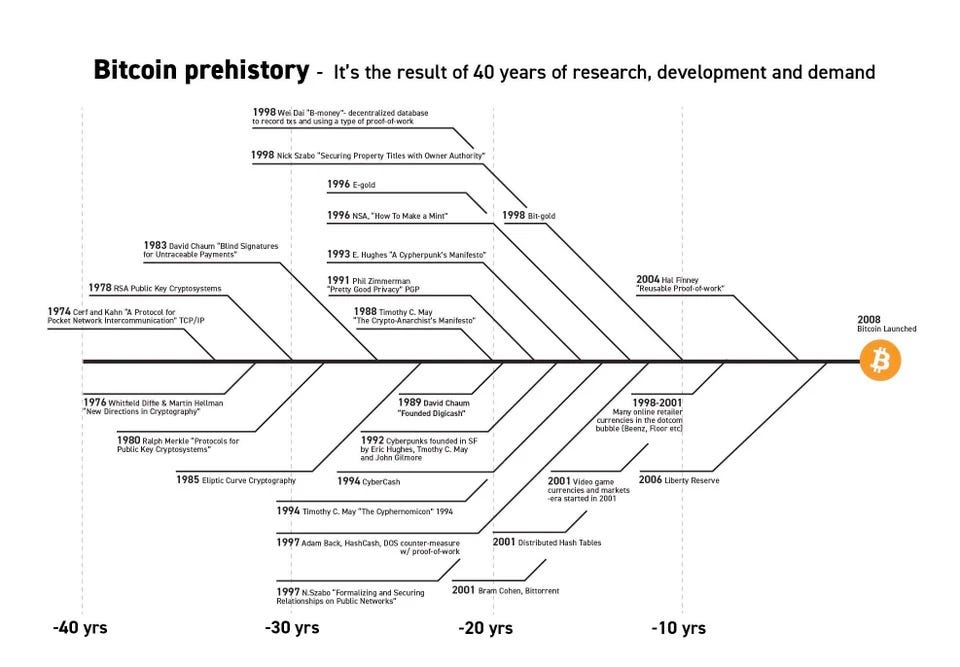

1. Bitcoin prehistory - It’s the result of 40 years of research, development, and demand

Before Bitcoin, there were a few intents to make an e-currency, projects like Bitgold and Hashcash were promising, but most of them failed, for lacking the features that made Bitcoin succeed. And these features are decentralization, censorship resistance, and fixed supply.

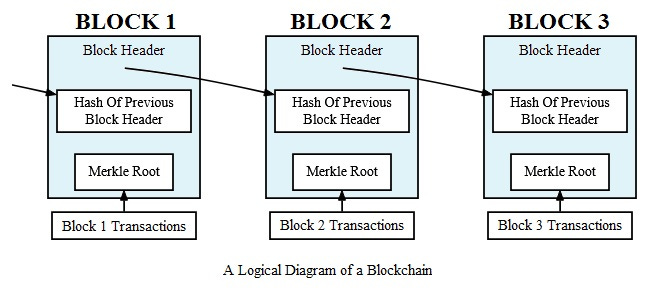

Decentralization: Bitcoin works by a network of computers called “blockchain”. The blockchain is a ledger that records all Bitcoin transactions in ‘blocks’ of data created every 10 minutes, which are then ‘chained’ in sequence to the next block, leaving a historical record of all the transactions dating back to the first transaction block.

The computers in this network are called ‘nodes’ or ‘miners’. Nodes are computers that keep a live record of the ledger, and miners are computers that participate in the process of confirming transactions, and by doing this work, miners get compensated by receiving a transaction fee which can vary, as well as a fixed reward, both paid in Bitcoin.

Censorship resistance: The Bitcoin network is an open-source protocol, meaning everybody with a computer or phone, regardless of age, nationality, or political bias can be a participant.

Bitcoin is pseudo-anonymous which means that no one knows how many Bitcoins belong to whom unless that person reveals their wallet information. Which brings financial independence from governments and banks.

Even countries that have made Bitcoin illegal, have struggled to stop its usage, actually quite paradoxically making it more and more adopted. Two-thirds of people around the world don’t have access to financial services like bank accounts because they lack basic requirements like an address, ID, or money. It’s free to create a Bitcoin wallet!

Fixed supply: The problem with Governments and Central Banks being in charge of the fiscal and monetary policies, often printing money for the benefit of themselves, is that they produce inflation which is a direct tax to holders of their currencies, devaluating people’s savings in the long run, especially in undeveloped economies, making investing a necessity rather than speculative.

Bitcoin’s supply is fixed and will always be, it’s hard written in its code, and no one can change it, not even the creators can, it will be like that forever, and you decide to participate or not.

1.1 Satoshi Nakamoto and the Cypherpunk movement

In 2008, coincidently the same year that the world experienced one of the worst economic crisis of modern history, a person or group of people under the name of Satoshi Nakamoto published the Bitcoin whitepaper on a public forum, ran by a community of coders with the title “Bitcoin: A Peer-to-Peer Electronic Cash System”.

The idea quickly gained a lot of interest, especially among the Cypherpunk community that was trying to invent a system for electronic transactions without relying on trust with privacy features using cryptography.

Until this date, no one really knows who Satoshi is, and this was done on purpose so there wouldn’t be a face behind the project. Other attempts to make independent and private digital currencies had failed due to government intervention, without a face behind the project there is no one to be liable or prosecuted.

1.2 The first Bitcoin transaction and the first Bitcoin purchase

In 2009, the bitcoin network came into existence with Satoshi Nakamoto mining the genesis block of bitcoin. Embedded in the coinbase of this block was the text:

“The Times Jan/03/2009 Chancellor on brink of second bailout for banks”

The text refers to a headline in The Times published on 3 January 2009. This note has been interpreted as both a timestamp of the genesis date and a derisive comment on the instability caused by fractional-reserve banking.

Hal Finney was the first person to receive Bitcoins. Finney downloaded the bitcoin software the day it was released and received 10 bitcoins from Nakamoto in the world's first bitcoin transaction.

Bitcoin didn’t have much value at that time, in fact for many years the price was 0. One day in May 2010, a man in Florida agreed to pay 10,000 Bitcoins for two delivered Papa John's pizzas by posting an ad on a Bitcoin forum. This is the original message sent:

"I'll pay 10,000 bitcoins for a couple of pizzas.. like maybe 2 large ones so I have some leftover for the next day"

A British man took the offer and bought the two pizzas in exchange for the 10,000 Bitcoins. Making it the first Bitcoin transaction, and from that point on, it became quite clear the potential that something like this could have not only in economies but in societies as well.

Just for reference, 10,000 bitcoins at $34,000 (today’s price) will be $340M.

2. Investing in Bitcoin: Good or Bad Investment?

Well to be quite honest is neither. Investing is a personal discipline that is aligned with each individual’s financial goals, and financial goals are usually tied to risk. Think about your financial goals for a minute, do you need this money to buy a house or support your family? Then go for a conservative approach. If you are in a position to take extra risks you can decide to do so as well.

The way that I approach investing is by asset allocation, meaning, how much of my personal net worth is put into an asset, diversification is important when investing because you don’t want to be very exposed to an asset because its fluctuations will directly impact your wealth. That fluctuation is called volatility and when it goes in your favor it’s good but not when it goes against you.

So putting all your money in one single asset is not recommendable, bitcoin is still a quite volatile asset. 1 - 2% can be considered conservative, but again you need to decide for yourself what is the right strategy for you.

2.1 When should I buy it?

It’s hard to predict markets, and you can lose a lot of money by doing so, that’s why investments should be treated as a long term game. I will share annualized returns for Bitcoin, Gold, and an Index of the USA’s 500 most valuable companies, to show that most investments tend to appreciate with time.

With the assumption of at least 2% inflation yearly, which is the target for most developed economies (and way more in undeveloped economies) we see that with time cash loses its value, bank accounts don’t pay high interest anymore, essentially taxing people for having savings.

This is why it’s better to invest constantly rather than putting all your money at once. Always set aside some money to be invested monthly or quarterly, this way you can average your price entries, which for Bitcoin is recommendable as the price fluctuates a lot.

2.2 Halvings

New Bitcoins are mined every ten minutes. The rewards are obtained by miners participating in the network, and this is how new Bitcoins are supplied to the market, the miners are incentivized to sell their Bitcoins to individuals at a profit to pay for the electricity costs required to mine those coins and keep the operation profitable.

The Bitcoin protocol is designed to be “deflationary” meaning that supply is being reduced every four years by half hence the term ‘halving’. when the Bitcoin network started, miners received 50 Bitcoins every ten minutes split among the participants, in 2010 it became 25, in 2014 12.5, and last year Bitcoin suffered another supply shock making the reward 6.75 BTC.

This means that every 4 years the intrinsic costs of mining one single Bitcoin doubles. And miners will not sell their coins at a loss, it wouldn’t be a business. So usually the price in the market is higher than the intrinsic value and the difference often called ‘spread’ is kept by the miners, which can be high or low depending on the costs of electricity which vary among jurisdictions.

Since theoretically, you will never reach a whole number dividing by half, you cannot technically mine 100% of all bitcoins, however, in around 100 years most bitcoins or 99% of the total supply of 21 million will be already mined. So far more than 18 million are already in existence.

Due to laws of supply and demand, assuming that inflation and adoption continue to rise demand, and the supply is always kept fixed, the price should also continue to rise. This is illustrated in a better way in this graph created by PlanB.

The Stock-to-Flow model treats Bitcoin as being comparable to commodities such as gold, silver, or platinum. These are known as 'store of value' commodities because they retain value over long time frames due to their relative scarcity.

3. Getting your Bitcoin

There a three ways of getting Bitcoins:

Mining

Accepting it as a form of payment for a product or service

Buying

In the early days, you could mine bitcoins from your laptop, but now that process is very competitive and not very lucrative anymore. So I will focus on explaining how to buy Bitcoin or accept it as a form of payment.

3.1 Accept Bitcoin

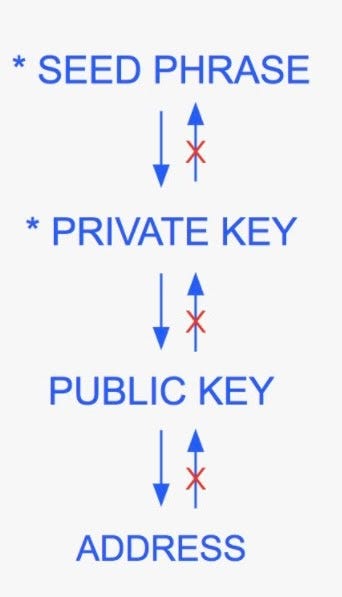

To start using Bitcoin you need to set up a Bitcoin wallet, to explain how wallets work and their security, I will explain the Hierarchical Deterministic wallet or HD Wallet.

When we think of wallets this picture comes to mind:

But we need to think about Cryptocurrency wallets more in this way:

And that’s because the cryptographic algorithm allows you to generate data from the source but it doesn’t allow you to look at the data where it was generated due to encryption. So a seed phrase which is a combination of words will essentially be your wallet, this generates a private key (which allows you to access the network and use the Bitcoins that you have stored at your convenience). A public key is created to be used as a source to create a public wallet address that people use to send you bitcoins.

This process can be better illustrated in this picture:

So never reveal your seed phrase or private key to anyone, whoever controls that data controls your money, and if someone else gets access to it the amounts cannot be recovered.

There are different types of wallets: hot or cold, and decentralized or centralized. They have different benefits and you can own one or more than one depending on your necessities.

Hot Wallets: These are wallets connected to the internet. Usually websites.

Cold Wallets: These are wallets not connected to the internet, usually in a hard drive or USB device. Less risky than hot wallets.

Decentralized: These are wallets that you control yourself, you need to protect your own keys, and as long as they remain private no one will have access to it, if you lose access to your private keys, you can regenerate it using your seed phrase, if you lose access to the seed phrase you can create another wallet and send your money there using the private key. If you lose access to both you lose control of your account forever, and cannot be ever recovered, even if you own the public key and the address.

Centralized: These wallets are custodians of your bitcoins meaning you don’t own the private keys we mentioned above, they act in the same way as a bank, they can be dangerous because you have to trust these entities, however, they take out the responsibility of protecting your own keys, if you don’t want to take that risk.

These are a few examples:

Hot Wallet, Centralised: Exchanges such as Coinbase or Binance use this model. You do not own your own keys, so you need to trust that entity, the benefit is that if you lose your password you can reset it through them.

Hot Wallet, Decentralised: These are services like BitGo or Blockchain.com that allows you to create a Bitcoin wallet while still allowing you to control your own keys.

Cold Wallet, Decentralised: These are services like Ledger or Trezor where you need to protect your keys and are considered the most secure because they are not connected to the internet and the private keys are held in a physical device rather than online.

Cold Wallet, Centralised: These are services that offer custody of large amounts of Bitcoin but are kept under decentralized cold storage. Some of them like BlockFi pay you a high-interest yield, in the same way as banks use to do.

Once you have access to your bitcoin public wallet address you can start accepting Bitcoins!

3.2 Buying Bitcoin

Another good and easy way to get exposure to Bitcoin is by buying it through an exchange.

In some countries, you can have access to Bitcoin ATMs which make the operation accessible with cash and protects your identity. But I will quickly mention a few common services to buy cryptocurrencies, these will vary depending on the country you live in:

Once you buy your Bitcoins you can leave it on the exchange, essentially allowing the entity to custody your coins or you can send them to your own cold wallet, just make sure to type the correct address if you send crypto to the wrong address it will not be recoverable, and to protect your keys.

3.3 Bitcoin Cash, Ethereum, DogeCoin, Other Cryptos?

There are around < 2,000 other cryptocurrencies in existence. Since Blockchain is an open-source technology everybody can use it to create a cryptocurrency like Bitcoin and tweak its characteristics to allow it to have different features. Other cryptocurrencies like Bitcoin Cash, Ethereum, etc. will be covered in the next installments. For now, however, I will only cover Bitcoin, as other coins lack some of the fundamental characteristics that I have explained so far.

3.4 Pros of owning Bitcoin

Easy to transport compared to gold. Highly divisible One Bitcoin nowadays is priced in the 5 figures, however, Bitcoin is divisible up to 8 decimal points so you can technically buy 0.00000001 of Bitcoin. Very hard (impossible) to counterfeit you cannot receive fake bitcoin.

4. Conclusion

Throughout the years’ humans have used different commodities as money, some civilizations used seashells and rocks. Most modern civilizations relied on gold because it was scarce, that’s why currencies used to be backed by gold. Nowadays no currency is backed by anything, including the US dollar.

In the last decades, countries like Portugal, Spain, Netherlands, France, Britain; enjoyed world reserve currency status at some point, but most of them lost that status for two main reasons: 1. Devaluing their currency to maintain their high credited economy. 2. Another empire would become more powerful therefore enforcing their currency and economic regulations.

Oftentimes these countries would go to war, printing money to maintain operations. By adding new money into the economy without value created, it dilutes the purchasing power of citizens by making everything more expensive. So world reserve currency status has lasted on average 100 years, I wrote an article on that subject which you can read here.

I believe we are seeing those same developments with the US and China, we are seeing the US plateauing in the late cycle of economic development. While China is estimated to continue growing, would the Chinese yuan be the next currency? perhaps it will become more popular, but this time in history, we have a new currency, born on the internet, without control of any government or individual, that can be used by anybody, anywhere.

Bitcoin is not only a new way of transferring money, it is the first time in history that we can record and exchange data without trusting a centralized entity. It’s also the first time in history that we can create digital scarcity, usually, once something is digital becomes easy to copy but with Blockchain technology, this is no longer possible, which makes it perfect for money, but also can be used for other application such as voting systems, supply-chain traceability, and medical records.