First of all I want to thank the audience that have read and subscribed to my Newsletter. I have a lot of fun writing these weekly articles and I hope you are enjoying yourself as you read them!

Everytime I am at the research stage of a newsletter, I discover new topics that can be added to future installments, on my previous newsletters I wrote about inflation in video games, and then the history of world reserve currencies, so for this week I want to talk about Central Banks Digital Currencies (CBDC) and what do they mean for the future of payments.

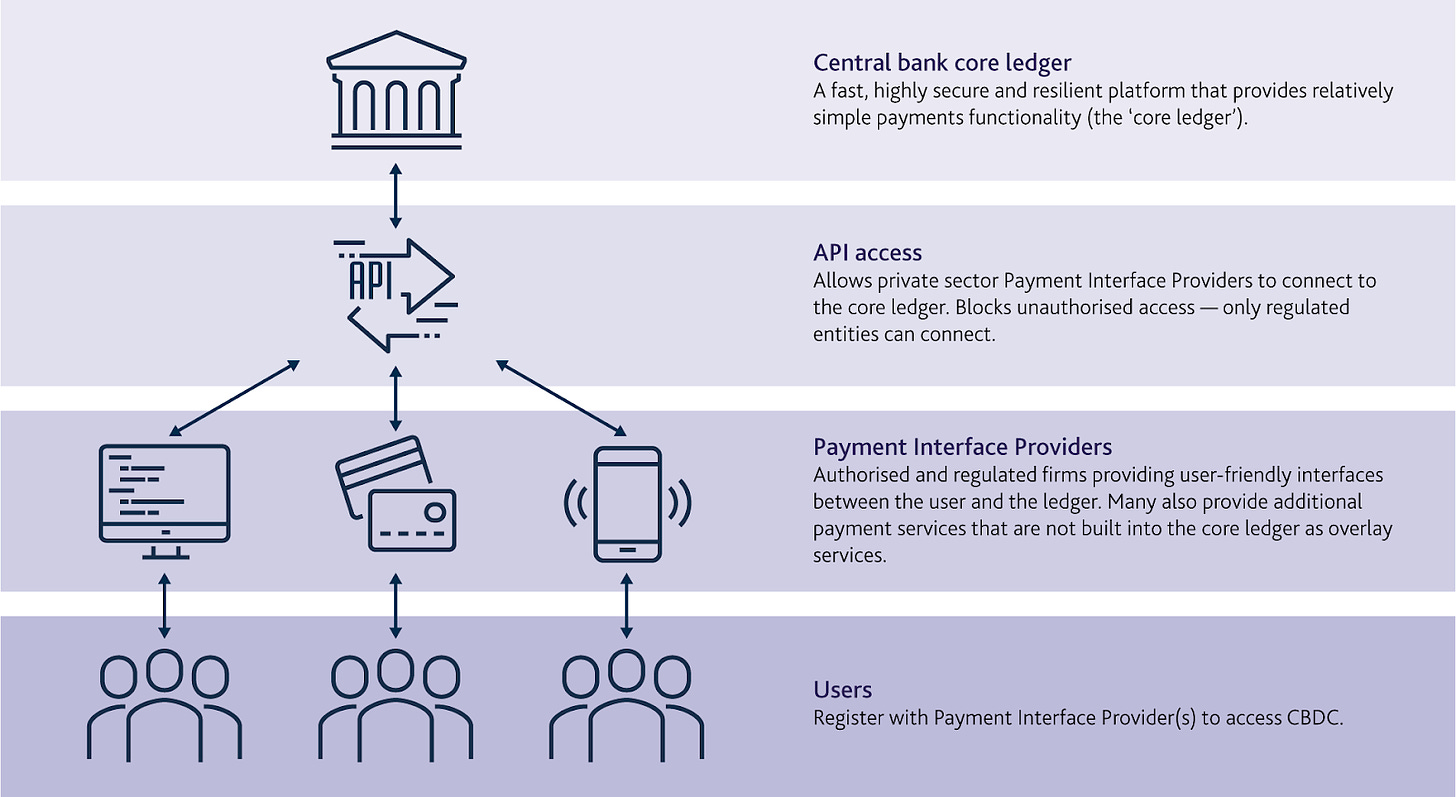

Let’s start by explaining what Central Bank Digital Currencies are, although still in proof-of-concept stage, CBDCs will be an electronic form of central bank money that could be used by households and businesses to make payments. They may use cryptography and blockchain technology although it is not required.

China

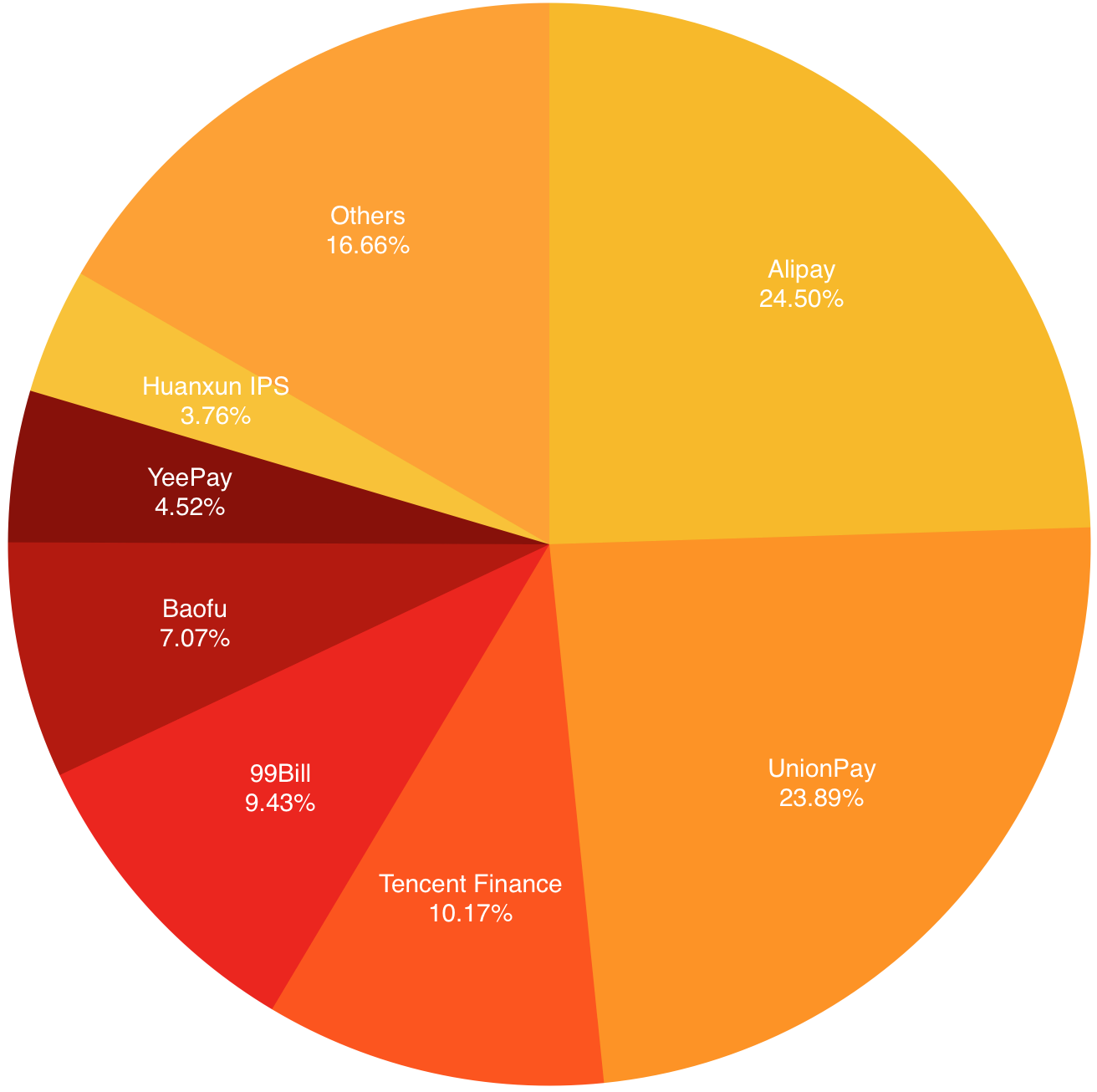

To provide a much clearer vision of what CBDCs are or what they could become, we need to redirect our attention to China. Why China? They have been using different forms of digital payment services such as WeChat and AliPay for many years now, in fact, over 80% of payments in china are digital, compare that to Latin-American countries where 85% of payments are made using cash.

China is also already testing their own CBDC as we speak, The Shenzhen government confirmed trials in the new platform and sent digital ‘red packets’ to 47,000 people containing 200 yuan to be used during a weekend for shopping, although this is not a cryptocurrency, people using the service didn’t seem to mind at all and the feedback was very positive.

By having their own platform and CBDC, China and other world powers can ditch the US dollar and use their system for international trade, this could benefit countries that have been sanctioned by the US or do not trust their government’s fiat money.

Other Countries Jumping into the CBDC Race

Countries like The United Kingdom, Australia, United States, Thailand, Germany, Sweden, are also joining the race to launch their version of CBDCs.

But why are these countries so interested right now? Well, the short answer is trust!

With countries like China already leading the race in this space, and private companies like Facebook already developing projects that create infrastructure for digital payments and currencies (Facebook Libra). People are losing trust in fiat money so there is no doubt that many world leaders want to keep their currency sovereignty in their hands.

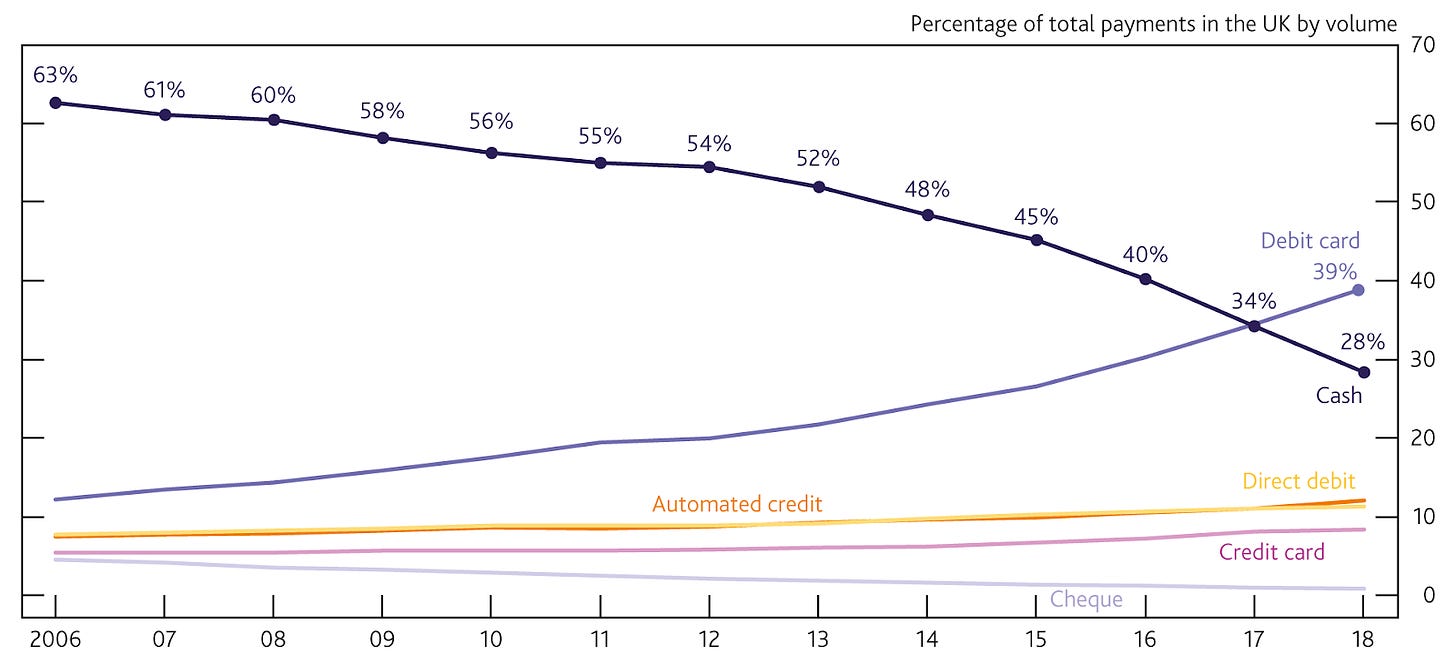

The way we shop and pay for goods has changed, we also need a new system that adapts to this change.

How do you prevent illicit activity while preserving user privacy and security?

This is a subject that comes up when discussing CBDCs. Going back to China, the government uses facial recognition technology to send jaywalkers instant fines by text, this means that the government officials will fine you and take the money out of your account before you even noticed that you did something wrong.

Privacy and decentralization is something that CBDCs currently lack and probably always will. This is why Bitcoin keeps being important and can coexist with digital state currencies because they cater to different needs.

This is why 10 years ago Bitcoin was just an experiment, 5 years ago many thought it was a scam when the price hit $1,000, now with the price even 33% down from it's all time high of $20,000 people’s faith in Bitcoin is high, with names like PayPal and DBS adding Bitcoin to their platforms as well as a number of other cryptocurrencies.

Universal Basic Income

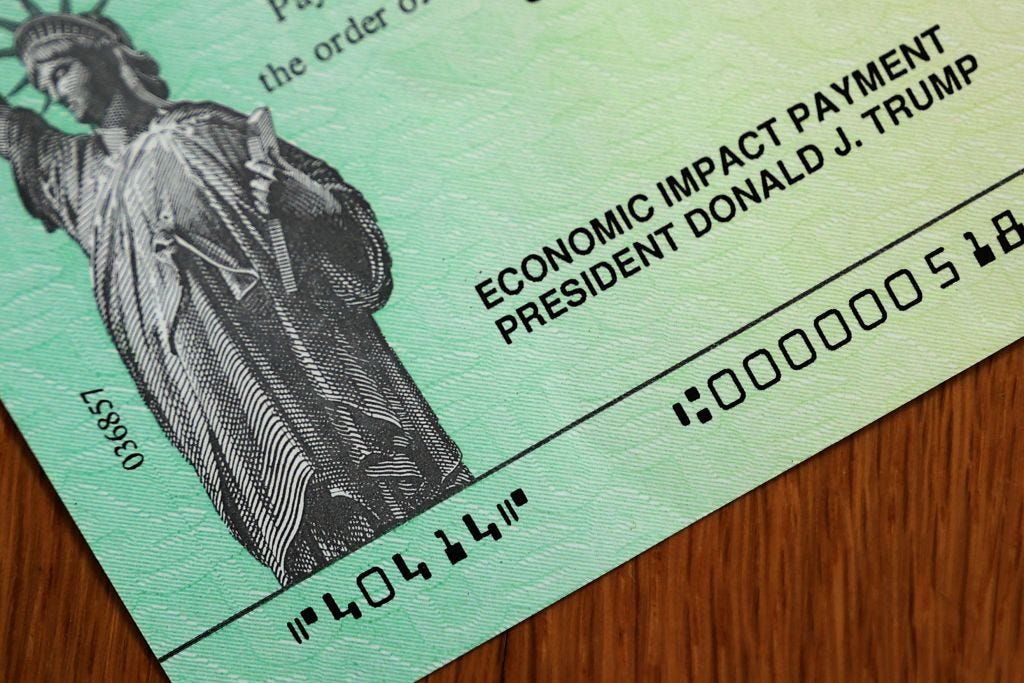

This year the Covid-19 pandemic forced many workers out of their jobs, which urged the US government to give financial stimulus in the form of checks to Americans. This process could take seconds using a CBDC platform rather than weeks.

Even though I don’t believe UBI is achievable now, I have a strong feeling it will catch-up in the future, a system of CBDCs can be more efficient than the current system.

Will Retail Banks Die?

With the rise of AI in fintech applications already taking some of the action of the retail bank space, and governments rushing to provide a much more convenient methods of payment directly from the central bank.

It’s hard to imagine where traditional banks fit in this future, perhaps that’s why some traditional financial companies are starting to look into Bitcoin and other cryptocurrencies as they could replace the current fiat monetary system of today.