The Complete and Simple Guide to Understanding and Buying Bitcoin in 2025!

Preface: First off, a huge thank you to everyone who read The Complete and Simple Guide to Understanding and Buying Bitcoin in 2021! I’m still getting notifications about people reading the article—and even subscribing to my Substack nearly four years later. That’s incredibly exciting to me! It shows there’s still so much curiosity around Bitcoin, and that’s exactly why I decided to create this updated version. Rather than repeating everything from the original guide (where I explain the history of Bitcoin, how it works, and how to buy it), this post will focus on what’s changed over the past few years and offer some predictions for where Bitcoin could be headed in the next four. LFG!!!

Let’s dive in:

1. Bridging the Gap Between 2021 and 2025 (What are the big new changes?)

Since 2021, Bitcoin has seen some remarkable developments. The Bitcoin ecosystem has matured significantly, and its role in the global financial system. In this section, we’ll explore some of the most important updates to Bitcoin’s network, adoption, and regulation.

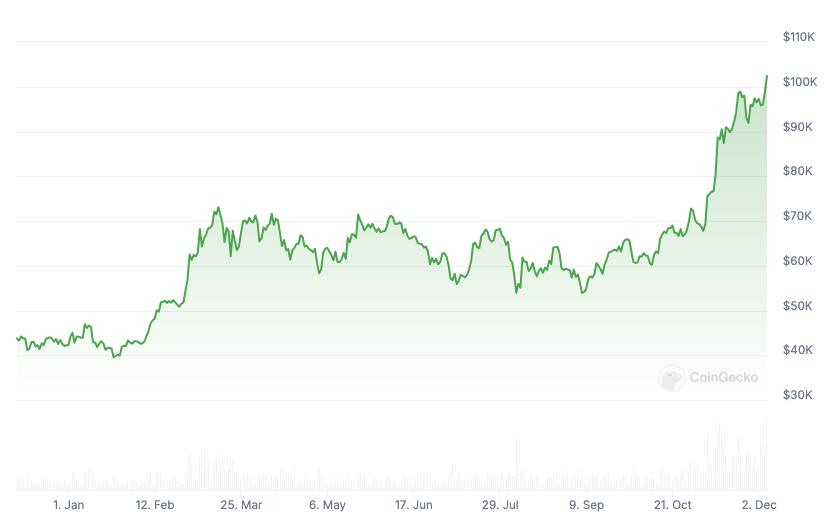

1.1 $100K (3X)

We couldn’t kick off a Bitcoin article without addressing its price, and yes, since I wrote my last article in February 2021—when Bitcoin was hovering around $30,000—it’s now surged more than 3x, reaching over $100K and approaching a market cap of nearly $2 trillion. That’s a pretty decent performance. For context, the S&P 500 has risen by about 55% over the same period. So, while Bitcoin’s volatility is undeniable, its growth has far outpaced many traditional assets.

1.2 The Bitcoin ETF

This is arguably one of the most significant recent developments, as it firmly reinforces the idea that traditional finance will inevitably converge with fintech and blockchain initiatives.

The launch of the first Bitcoin Exchange-Traded Fund (ETF) is a milestone the crypto community had long been anticipating, marking Bitcoin’s official entry into the mainstream. Now, investors can gain exposure without the hassle of private keys, managing wallets or navigating exchanges. For years, Bitcoin skeptics dismissed it as too volatile, too risky, and too "unconventional" for institutional investors. But with the Bitcoin ETF, access to Bitcoin has become seamless.

1.3 Institutional Adoption and Bitcoin as a legal tender

Since 2021, one of the most significant developments in the Bitcoin ecosystem has been the growing institutional interest in the cryptocurrency—not just as a speculative asset, but as a legitimate treasury reserve. This shift has been largely driven by prominent Bitcoin advocates like Michael Saylor, CEO of MicroStrategy, and Nayib Bukele, President of El Salvador, who have both championed Bitcoin as a critical part of their balance sheets. In early 2021, Tesla, led by Elon Musk, made a landmark move by purchasing $1.5 billion worth of Bitcoin, making it one of the largest corporate Bitcoin acquisitions at the time. While Microsoft shareholders voted against adding Bitcoin to the company’s balance sheet in 2024, the mere fact that the topic is being discussed highlights the shift in how Bitcoin is now perceived compared to just a few years ago.

Now, the U.S. wants to enter the game as well. With Donald Trump winning the presidency, reports surfaced that he’s considering creating a Bitcoin Reserve, potentially using Bitcoin as a key asset to back the U.S. dollar or as part of the nation's treasury strategy.

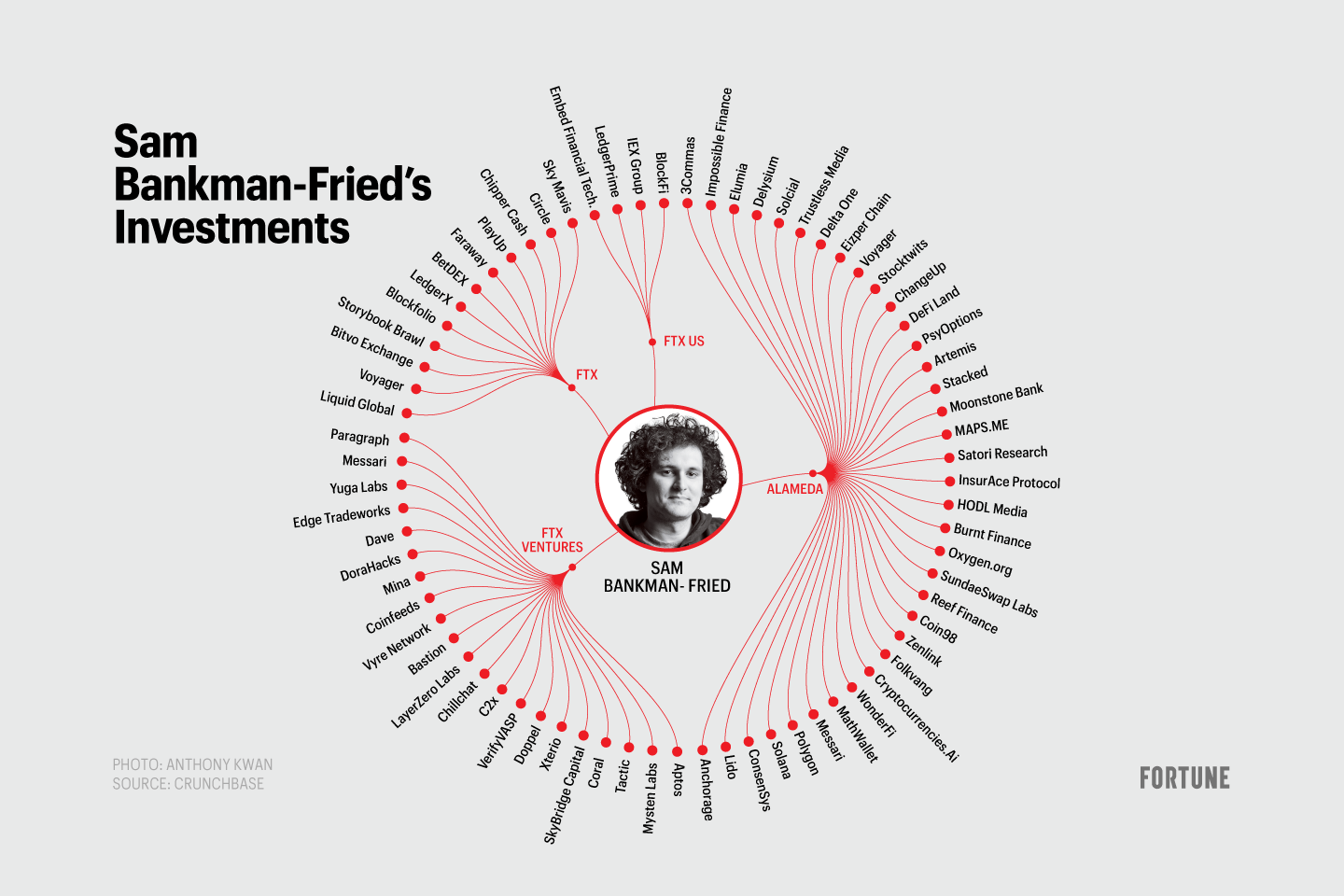

1.4 The Crash of FTX (Blockfi, Celsius, Luna)

In 2022, the Bitcoin and crypto markets experienced one of the largest crashes in their history, triggered by the collapse of FTX due to mismanagement of customer assets. FTX was one of the largest and most influential cryptocurrency exchanges in the world, serving millions of users globally. The fallout from FTX’s bankruptcy rippled throughout the industry, leading to the collapse of several major companies, including Luna, Celsius, BlockFi, and others. At its peak, the total crypto market cap was $3 trillion, but within months, the sector lost over $2 trillion in value, with Bitcoin dropping nearly 80% and many other cryptocurrencies falling even harder.

FTX alone lost $12 billion in customer assets, and one of the largest names in crypto was forced into bankruptcy. Sam Bankman-Fried, the founder of FTX, is now facing criminal charges and is currently in jail. While this moment seemed like the end for the crypto industry, it ultimately strengthened the case for greater transparency and regulation within the space.

2. What Happens Next? 2025 - 2029

Now that we’ve covered the key developments of recent years, it’s time to look ahead at the events that will shape the future (and the price) of Bitcoin.

2.1 The U.S. as an International Crypto Hub & The Dollar Collapse

The collapse of the dollar is no longer a distant possibility. In his book The Bitcoin Standard, Saifedean Ammous explores how currencies throughout history have gone through cycles of rise, dominance, and eventual failure for various reasons. I even wrote an article years ago about the inevitable decline of imperial currencies and how every global reserve currency has failed after a period of dominating world trade. [World Reserve Currencies last on average 100 years. The US dollar has been the reserve currency for 76 years]

Under Donald Trump, the U.S. is now considering the creation of a Bitcoin Reserve to back the dollar. Why not? The U.S. already controls the world’s reserve currency—why not leverage that power to acquire what could be the next global financial asset? After years of attempting (and failing) to prevent the growth of blockchain infrastructure, now with Trump in the White House this could change.

If the U.S. follows through with this initiative, it will not only place the country at the forefront of the crypto revolution, but it will spark a global race for Bitcoin, with countries and corporations scrambling to acquire as much as possible, pushing its price and scarcity to new extremes. The race to own the most Bitcoin will likely become the defining financial competition of the next decade, further blurring the lines between traditional finance and blockchain innovation on an unprecedented scale.

2.2 Russia and China using Bitcoin and BRICS creating CBDCs

Many countries—especially those outside the traditional financial system or those impacted by Western sanctions—are increasingly exploring alternatives to the U.S. dollar, including central bank digital currencies (CBDCs) and Bitcoin, as means to gain financial autonomy.

Russian companies have begun using Bitcoin and other cryptocurrencies for international payments, while China has reversed its long-standing ban on Bitcoin, allowing citizens to engage with the asset. Meanwhile, the BRICS nations (Brazil, Russia, India, China, and South Africa) have been discussing the creation of a new reserve currency, potentially backed by a basket of their national currencies. The EU and the U.S. have also shown interest in CBDCs, but they lack the key advantage that Bitcoin offers: permissionless payments. Bitcoin allows anyone, regardless of nationality, race, socioeconomic status, or political views, to participate in its network, making it an inherently inclusive currency. This unique characteristic elevates Bitcoin’s case as a truly sovereign currency, free from centralized control or government oversight, further solidifying its potential as a global alternative to the dollar.

2.3 Regulation, Regulation, Regulation!

With the increasing institutional interest in Bitcoin, governments are now recognizing the need for regulation, which is a logical next step after years of largely ignoring the space. The EU has launched the MiCA framework, aiming to enhance compliance for companies dealing with crypto-assets and provide a clear regulatory structure. Meanwhile, the UAE requires businesses in the crypto space to obtain a license from VARA (the Virtual Asset Regulatory Authority) to operate. The U.S. is expected to unveil its own regulatory strategy in the near future, signaling a more structured approach to the industry. While Bitcoin itself is difficult to regulate due to its decentralized nature, governments can certainly regulate the companies that use it, particularly in areas like anti-money laundering (AML) and know-your-customer (KYC) practices.

One thing is certain: most countries are eager to tax crypto gains. As the industry grows, governments are increasingly focused on ensuring they capture revenue from the booming digital asset market, making tax reporting and compliance a central aspect of future crypto regulation.

3. Predictions

Just to make this article a tiny bit more exciting, here are my three predictions I believe will shape the future of Bitcoin over the next decade:

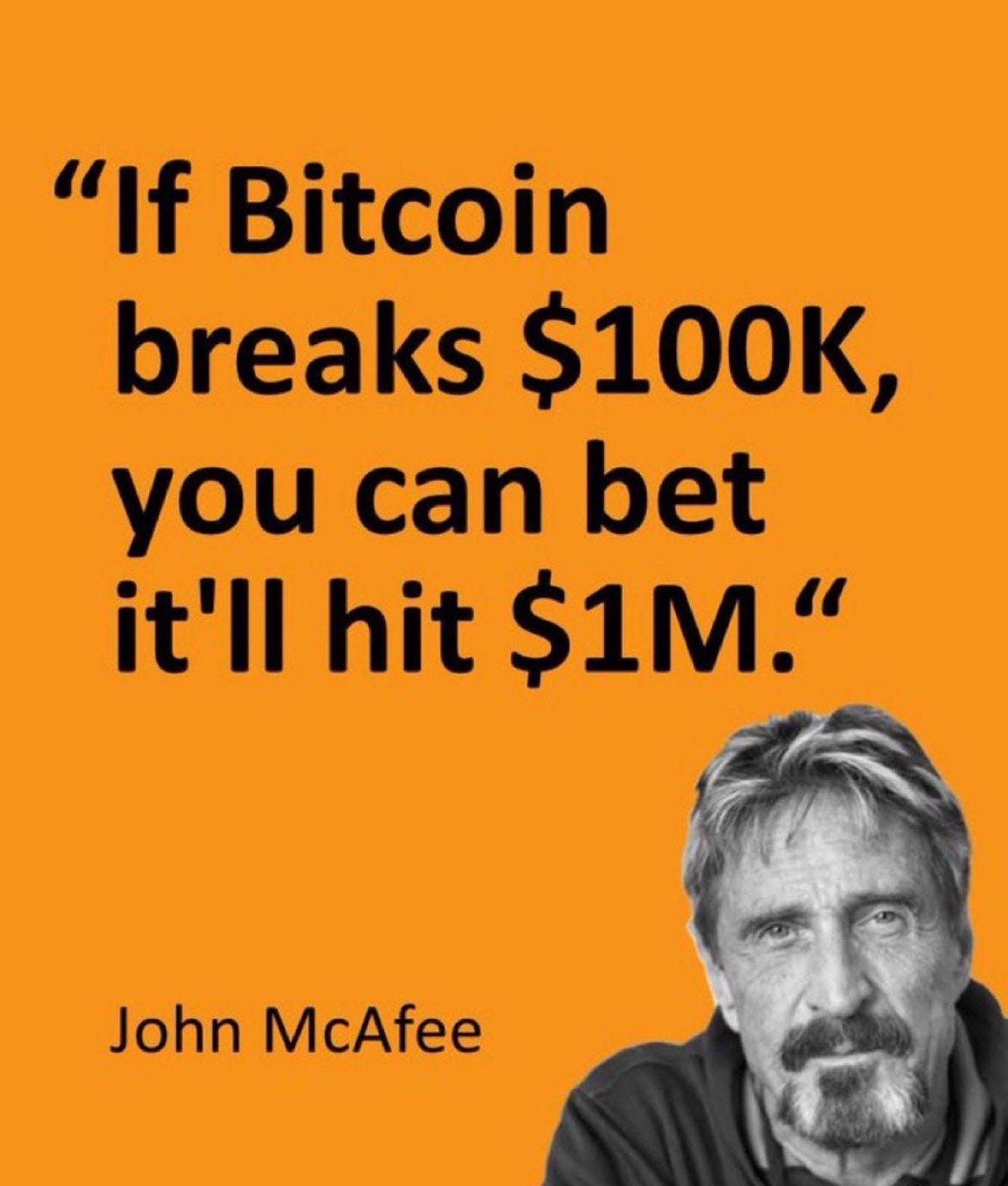

Bitcoin will reach the Market Capitalisation of Gold — The market cap of BTC is currently around $2 trillion, roughly 10% of gold's market cap, which stands at about $20 trillion. For Bitcoin to match gold’s market cap, it would need to increase tenfold, pushing its price to approximately $1 million per coin.

A BlackRock-influenced hard fork (or should we call it a “Black Fork” or “Hard Rock”?) — jokes aside, a hard fork occurs when a blockchain splits into two separate chains, typically driven by new upgrades, features, or disagreements within the community. The term "hard fork" comes from the fact that miners and other network participants fail to reach consensus on which version of the blockchain is the “true” one. This split results in two parallel ledgers and two different currencies. A famous example of this happened in 2017, when Bitcoin split into Bitcoin Cash and Bitcoin (Core) following a debate about how to scale the network.

Many speculate that BlackRock might seek to orchestrate such a fork in Bitcoin’s future, potentially pushing for changes like altering the 21 million coin supply limit—a foundational aspect of Bitcoin’s protocol.

MicroStrategy or BlackRock will ignite the next crash: every market cycle, there’s usually a triggering event that sparks a massive sell-off, leading to a bear market that typically lasts for a couple of years. The last crash was ignited by the FTX debacle, but many experts now speculate that large institutional players like MicroStrategy or BlackRock could be the next to set off such a chain reaction. With their substantial Bitcoin holdings and influence, any major sell-off or mismanagement by these giants could have a profound impact on the market, triggering another wave of declines.

4. Conclusion

Whether or not you fully understand it or not Bitcoin is here to stay!

Many traditional financial institutions have made it easier than ever to send, receive, and gain exposure to Bitcoin—whether through ETFs, CFDs, or other financial products. What began as a niche asset for tech enthusiasts has now evolved into a mainstream phenomenon. With institutional adoption increasing and governments starting to take it seriously.

Looking ahead, the potential for Bitcoin’s global influence is immense. The U.S. considering a Bitcoin Reserve to back the dollar, along with Russia, China, and the BRICS nations exploring alternatives to the dollar, signals a seismic shift in how the world views money. Central bank digital currencies (CBDCs) may rise as competitors, but Bitcoin's permissionless, borderless nature gives it an edge that no government-backed currency can replicate. Meanwhile, regulatory frameworks like the EU's MiCA and VARA in the UAE are starting to shape the landscape, pushing for more transparency and compliance in the crypto space.

The next decade will be critical for Bitcoin as it continues to blur the lines between traditional finance and blockchain innovation, emerging as one of the most defining financial assets of the future. Thanks for reading and see you in 2029!!!

What other ideas or predictions do you think I missed? What topics would you like to see covered in my next article? Let me know your thoughts!